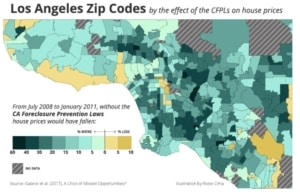

In the midst of an affordable housing crisis in California, UCLA economists have the balls to put out a study trumpeting the success of California’s 2008 anti-foreclosure law.

Their definition of success? Housing prices are now 15% higher than they otherwise would have been… up to 60% higher in some middle-class neighborhoods of Los Angeles.

Our politicians continue to pass laws — often with the backing of prominent economists — that drive up the cost of education, health care, and housing.

Isn’t it at least possible that one reason we all feel less secure is that the government is driving up the cost of those things that are most critical for a sense of well-being and security?